FROM: Ed D'Agostino, Publisher, Mauldin Economics

TO: Investing in the New Normal Viewer

DATE: June 30, 2025

SUBJECT: The Next Step

You just took a big step forward.

By watching Mauldin Economics' exclusive online event Investing in the New Normal, you heard the world's top investors and analysts provide valuable insights into how market-altering events will affect your investment portfolio.

Now, you need to turn that insight into action.

Knowing what region or what asset class to focus on is critically important. But to successfully navigate the new normal, you also need to know what exactly to buy, when to buy it, and when to sell it.

I hope you keep reading, because I want to tell you about something that will make these investment decisions a whole lot easier.

Ed D'Agostino

My name is Ed D'Agostino, and I'm the publisher of Mauldin Economics. As many viewers of Investing in the New Normal surely noted, income investing was a particular focus of our webcast. Why?

Because finding safe, cash-generating investments is one of the most challenging tasks for any investor in 2013.

Today's income investors are often faced with a choice between investments generating no value and those that are seriously overvalued.

I understand if you're stressed out and uncertain about where to turn. Most investors are.

Stuffing money under the mattress may not look so bad when CDs and money markets pay virtually nothing and most bonds are overpriced.

Meanwhile, many income-focused investors have turned to dividend paying stocks – and they've been handsomely rewarded in recent years. But the run-up in these typical value stocks has some trading at higher valuations than growth stocks – leading analysts to wonder if this asset class as a whole is getting frothy.

The Easy Money Has Been Made

Speaking of frothy: equities of all kinds have continued their relentless march upward for most of 2013. But anyone who watched Investing in the New Normal knows that plenty of risks still remain in this market, from the unanticipated effects of central bank money printing to more turmoil in the Euro Zone to more dysfunction in Washington.

That doesn't mean it's time to run away from equities and other risk assets. While it's clear to us at Mauldin Economics – and to our Investing in the New Normal experts– that much of the easy money has been made, there are still plenty of promising opportunities.

If you were smart enough – or lucky enough – to be heavily invested in equities over the last few years, you've probably done very well. You could've plopped cash into virtually any equity index or mutual fund at any time since 2009 and been sitting pretty today.

But we're entering a more volatile period where the upside will be harder to find. Investors will need to be selective and strategic in allocating their money.

In the months and years ahead, successful investors will be the ones who can identify real value and make sense of the megatrends and macroeconomic issues that are driving our interconnected global economy.

You need to be able to foresee what will happen and who will benefit.

Most investors don't have the time, analytical tools, or contacts to do this on their own. But we do at Mauldin Economics, thanks to our unparalleled combination of analysis and access to the key decision makers who move world markets.

The access comes courtesy of our founder John Mauldin – who travels the globe speaking to and with multibillion dollar money managers, CEOs, policymakers, and market prognosticators. The pros you saw on stage at Investing in the New Normal are just a few of the boldfaced names you will find in John's Rolodex.

John picks up ideas and insights from all over the globe, which he shares through his free newsletter Thoughts from the Frontline – one of the most widely read investment newsletter in the world.

But with many of our readers clamoring for more concrete investment advice, Mauldin Economics has also launched a series of investment products that provide actionable buy and sell guidance and portfolio construction to a variety of investors: from retirees and near-retirees looking for wealth preservation and income, to sophisticated investors searching for aggressive plays to generate capital gains.

I want to talk to you about one of those publications today. It's called Yield Shark – and it could be your ticket to double digit income in a single-digit world.

The Impossible Hunt for Yield

The collapse in asset yields is causing heartburn for investors of all kinds.

And it simply could not come at a worse time.

People are living longer, which means they need their savings to last longer.

But that can seem impossible when traditional safe havens, like Treasury and CDs, are often paying out well under 1%. The picture is even more grim when you consider the fact that regular interest income is often taxed as much as 2.5 TIMES as much as dividend income.

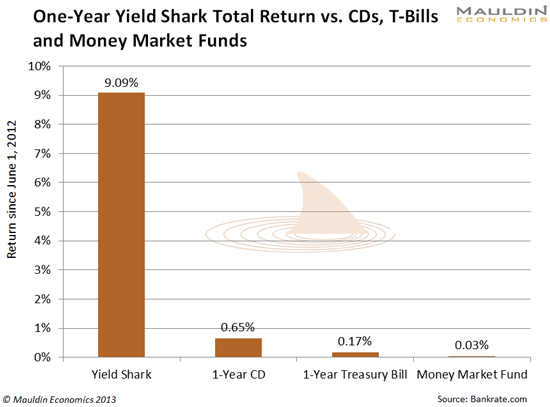

These "safe" assets are virtually guaranteed money losers – as these minuscule returns will be swamped by even moderate inflation in the years to come. For example:

And that's in just one year. It gets even worse over time.

So investors are searching for higher yield, but they're often not liking what they find. Sure, there is no shortage of assets paying 8%. The problem is that most high-yielding bonds aren't creditworthy, and many of the companies sporting juicy yields are poorly run, cash-poor, or both. You're risking huge hits to your principal when you roll the dice on these types of investments.

What you need instead, are investments that are both fundamentally sound and poised to capitalize on the big trends shaping our economy.

That's exactly what you will find in Yield Shark.

Yield Shark: Digging Deeper and Going Farther

Our exclusive picks are screened using thousands of data points that take into account everything from earnings growth and operating leverage to the sustainability of a dividend and volatility. We're crunching all these numbers to uncover investment recommendations with lower risk, higher yield, and better opportunities for capital appreciation.

Our Yield Shark team knows you need to dig deeper and go farther to find real value in today's marketplace. That's why recent Yield Shark recommendations have hailed from places as diverse as Israel, Norway, Australia, and Taiwan.

The Yield Shark team is doing sophisticated analysis, but we're focused on making things simple for investors. You don't need more complexity in your life. That's why every investment we recommend can be purchased on a US exchange. If you've got a brokerage account of any kind, you can replicate every selection we make.

But where Yield Shark really sets itself apart is in seeing where the world is going. If you looked at recommendations in our recent issues, you would see companies poised to capitalize on megatrends like:

3D Printing

This breakthrough will allow companies to do things that only a few years ago were still the stuff of science fiction. It is an innovation that the Economist recently declared "is likely to disrupt every field it touches."

A 3D printer looks similar to a traditional printer, but instead of using ink, it can use powdered plastic, metal, concrete, glass, and countless other substances to create almost anything. These printers can produce jewelry, replacement human bones and organs, auto parts, guns, and just about every other object you can think of.

The upshot for companies that figure out how to capitalize on this technology is significantly less waste, lower labor costs, faster innovation cycles, and almost endless customization.

Yield Shark uncovered a company that appears to have it figured out – an international business that is pioneering 3D design tools for a variety of industries.

It isn't often that you find a rapidly growing company in an explosive industry that is selling at a steep discount AND pays an 8.6% dividend. But that's exactly what Yield Shark did.

| This Company is a 3D Pioneer | |||

|---|---|---|---|

| Market Capitalization | $61.4 million | LT Debt-to-Equity Ratio | 52.0% |

| Forward P/E | 13.5 | Current Ratio | 1.1 |

| Dividend Yield | 8.62% | Net Margin | 8.2% |

| Payout Ratio | 226.7% | Cash on Balance Sheet | $9.4 million |

The Return of Housing

Residential real estate is on the rebound in America, with unit sales and prices on the rise across the country and many buyers being enticed by 30-year mortgage rates that are now well below 4%.

Meanwhile, Zillow has recently reported that over 70% of the 253 different housing markets it tracks have very likely hit bottom.

There is no shortage of real estate and REIT stocks to choose from, but there are not many that fit Yield Shark's stringent criteria for yield, growth, and risk management. But we've recently targeted two very attractive investments: a venerable developer and operator of retirement communities in the Midwest and Southeast, and a company that is one of the largest owners of forest land (lumber!) in America. Yielding a solid 4.7% and 3.3% respectively, these picks are poised to ride a long-term rebound in US housing.

| This Company is Housing the Baby Boomers | |||

|---|---|---|---|

| Market Capitalization | $1.9 billion | LT Debt-to-Equity Ratio | 294.1% |

| Forward P/E | 30.9 | Current Ratio | 4.0 |

| Dividend Yield | 4.78% | Net Margin | 2.2% |

| Payout Ratio | 1,010.3% | Cash on Balance Sheet | $61 million |

| This Company Owns Lots of Land and Lumber | |||

|---|---|---|---|

| Market Capitalization | $8.0 billion | LT Debt-to-Equity Ratio | 237.9% |

| Forward P/E | 31.4 | Current Ratio | 1.1 |

| Dividend Yield | 3.35% | Net Margin | 17.1% |

| Payout Ratio | 118.3% | Cash on Balance Sheet | $296 million |

American Energy Independence

This idea was unthinkable just a few years ago. But a new report from Citigroup concludes that the US may be only five years away from no longer needing to buy oil from any source other than Canada.

Thanks to the growing use of new hydraulic fracturing (fracking) technology, the US is awash in a sea of oil and gas. But capitalizing on this development is a lot tougher than just throwing money at companies pulling the black gold out of the ground. The downside of more oil and gas supply is sinking prices, which could mean a bumpy ride for many energy exploration companies.

But exploration isn't the only play here. Recently, Yield Shark found a solid and seemingly sleepy company that produces equipment that helps ship oil and gas all across America. This company yields a relatively modest 1.5%, but we think it has plenty of room to grow, as it carries very little debt and isn't nearly as dependent on commodity prices as other oil and gas plays.

| This Company Gets the Oil Where it Needs to Go | |||

|---|---|---|---|

| Market Capitalization | $720.4 million | LT Debt-to-Equity Ratio | 39.3% |

| Forward P/E | 8.2 | Current Ratio | 2.7 |

| Dividend Yield | 1.49% | Net Margin | 9.6% |

| Payout Ratio | 15.3% | Cash on Balance Sheet | $56 million |

No Two Investors Are the Same

These are just a few examples of the type of income opportunities that you will find in Yield Shark. And we won't just tell you what to buy. We will tell you what price to buy, what price to sell, and perhaps most importantly, what assets may fit your risk profile.

We know that every investor has unique needs depending on their stage of life and investment goals. That's why Yield Shark offers three different kinds of investments for its subscribers:

-

International Income: brings you additional income-boosting recommendations from overseas investments. Foreign companies tend to pay much higher dividends than US counterparts, and these investments have the added benefit of protecting your wealth from any drops in the value of the US dollar.

-

Double-Digit Income: enables you to get a bit more aggressive. It's more risk – but it's calculated and designed to goose your income without leaving you open to gashes in your principal.

-

The Best of Both Worlds: delivers a combination of lower-risk, higher-yielding investments for both income and capital growth.

The Two Key Questions in Your Head

Now that I've told you what Yield Shark does, how we do it, and what we offer, I imagine that you are thinking about two essential questions:

How has Yield Shark performed? And what's a subscription going to cost me?

Fortunately, I have great answers to both those questions.

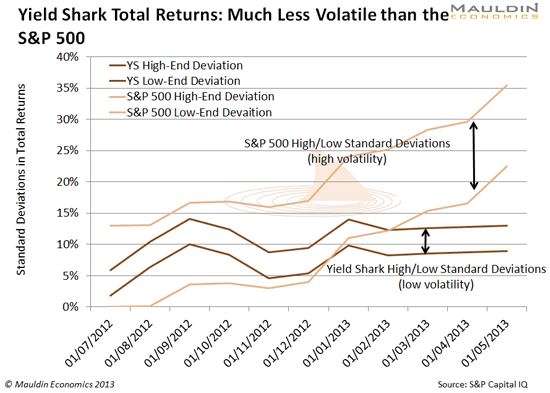

First, the performance. Yield Shark has offered our subscribers two things that every serious income investor should be looking for:

-

Portfolio returns that far outpace traditional fixed income options

Combined With

To date, much less volatility than the S&P 500

In the last year, Yield Shark recommendations have delivered a 9.09% total return while offering dependable income distributions and a much smoother ride than broader equity markets. That's exactly what most income investors are looking for.

Now, here comes the best part. You can get access to these unbelievable insights – insights that can boost your income by thousands or more – for only $99.

Yield Shark normally sells for $199 a year, but we're going to give you half off if you sign up right now.

For that $99, you will get a one-year subscription to Yield Shark, which is published once a month. In it, you won't just find recommendations for what to do. We'll tell you why – with detailed and accessible analysis to explain how we arrived at our conclusions.

Remember when your high school math teacher told you to always "show your work" when you worked out a problem? That's exactly what you can expect from Yield Shark.

But your $99 is actually going to buy you more than just 12 issues of Yield Shark. We know that the market sometimes moves a lot quicker than we can publish. That's why all Yield Shark subscribers will also receive periodic alerts from our analysts when we see a big market development substantially affecting one of our investment recommendations.

And if you purchase this Yield Shark subscription right now, I'm going to include two special reports that every income investor needs to read.

You'll get The Mauldin Economics Solution – Double Digit Income in a Single Digit World, which you can think of as the Rosetta Stone for Yield Shark, because it is the key to understanding the Mauldin way of income investing. In this report, we share our perspective on everything from the numerous assets available to income investors to portfolio construction and investment tax planning. You'll want to read this right alongside your first copy of Yield Shark.

Subscribe to Yield Shark now and you'll also get The Best Income ETF You've Never Heard Of. We will tell you about an ETF that can be a core holding for any income investor because it provides exposure to solid dividend payers in almost every corner of the globe, from the US and Sweden to South Africa and Thailand. You won't want to miss out on this pick.

This is Your Chance to Sidestep the Risks

and Seize the Opportunities

The value that Mauldin Economics is offering you is simply tremendous. Just $99 is getting you a year of Yield Shark, our timely investment alerts, and our two special reports.

All for just $99. I think it's more than worth it to pay 99 bucks to potentially make thousands more. I hope you agree.

Mauldin Economics believes in this product. I believe in this product. And I'm willing to back it up.

If Yield Shark isn't everything you expected – if it disappoints you in any way – simply cancel your subscription within 90 days for a 100%, no-questions-asked refund.

Even if you cancel after 90 days, you'll receive a refund for any unused portion of your subscription. But I'm confident that won't be necessary because of the tremendous feedback we have already received from current Yield Shark subscribers. See for yourself:

Yield Shark is perfect for us. My brother and I (in our low 50's, each with a family) just inherited some funds from our parents and have been struggling with how to manage it. Thanks for launching this new service. – Roger D.

Just purchased a subscription to Yield Shark – loved the first 3 recommendations.

Thank you. – Lance M.

Yield Shark has been especially informative. You provide great insight into the "Why's" of this crazy economic time we are living in. Thank you for that. – Lew G.

We get messages like this all the time from our subscribers and it just motivates us even more to provide the best product that we can for investors like you.

To sign up for Yield Shark now – to receive monthly analysis and ongoing recommendations to help you find safe upside in this upside-down world – just click here.

The investment landscape in 2013 can be confusing and scary for even the most sophisticated investors. But you can weather this uncertainty, and even more, you can profit from it.

Mauldin Economics is offering you an exclusive opportunity to sidestep the risks and seize the opportunities that are out there for income investors.

Take advantage of it. You will not be disappointed.

Sincerely,

Ed D'Agostino

Publisher, Mauldin Economics

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use.

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com.

Disclaimers

The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Thoughts from the Frontline Audio, Outside the Box, Over My Shoulder, World Money Analyst, Bull’s Eye Investor, Things That Make You Go Hmmm..., Just One Trade, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

Past performance provided in this publication is not indicative of future results. Performance is not GIPS compliant. Methods of terminology are available upon written request.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC.

Affiliate Notice

Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service.

Copyright © 2013 Mauldin Economics, LLC

Subscription Now

Subscription Now